Message from the President

Demonstrating strong leadership and taking on challenges myself

Q: As president of the Nippon Shokubai Group, what do you wish to bring to society? And, what kind of leadership do you believe is necessary to achieve this?

A: What I wish to accomplish as president boils down to achieving our Group Mission, TechnoAmenity. Through our business, we aim to help build a society where people can live comfortably and with a sense of security. I believe this will lead to a sustainable society. It is our reason for being, as well as my own mission.

TechnoAmenity is a term we coined in 1990. I don’t think the word “sustainability” was used as widely back then as it is today, but we have consistently upheld this mission to the present day. There have been discussions about changing the term several times, but we always end up sticking with it.

To realize TechnoAmenity, I believe that I must be a strong leader. However, it’s not about blindly pushing forward. What’s needed is the power to change for the better without being bound by the past. It’s crucial that I take on challenges myself as president and lead by example.

Three years into my tenure, I’ve implemented many changes, one being our personnel system—specifically, changing the very method of evaluation. We’ve shifted to a system that not only evaluates results against targets but also the act of taking on difficult tasks. We are especially firm on this with executives and upper management, for whom maintaining the status quo will not be rewarded. The evaluation asks what challenges were taken on and what changes were made.

Of course, I, as president, am no exception. Of the three transformations outlined in our Long-term Vision for FY2030—Business Transformation, Strategic Transformation for Environmental Initiatives, and Organizational Transformation—the latter two are progressing largely as planned. However, the crucial Business Transformation is lagging behind expectations. I often get asked by people inside and outside the company if this can really be done, and they want to know how committed I am as president. I tell them that I’m putting my neck on the line every day. I don’t think true transformation is possible without that level of resolve.

I’ve always been someone who constantly thinks “this must be changed.” Since I was young, whenever I thought something was wrong, I’d bluntly speak my mind to those above me and get scolded. That part of me hasn’t changed. I also believe that witnessing the mindset of global companies and the way they are structured when I was in my early 30s was very formative. The way they think is completely different. Buyers and sellers are equals, and win-win relationships are emphasized, while everyone firmly asserts their own ideas in meetings. There is rigor, yet diversity is also embraced. Witnessing this reaffirmed my belief that this is how business should be.

Ultimately, from my 30s to 50s, I learned a great deal by placing myself in environments where it was normal that meetings would involve people from several countries. Nothing will change by staying cooped up in Japan.

The previous Mid-Term Management Plan:

Targets unmet but groundwork progressed

Q: Please summarize the previous Mid-Term Management Plan, including lessons learned.

A: As mentioned earlier, the previous Mid-Term Management Plan (hereinafter “the previous MTMP”), which concluded at the end of March 2025, saw delays in business transformation. Consequently, the Solutions Business, which we had positioned as a growth business, did not grow as much as initially expected. The primary reasons were the impact of the economic downturn and inflation even after the COVID-19 pandemic, coupled with the fact that attempting to grow all ten of our business areas simultaneously resulted in the dispersion of resources. Consequently, we did not meet our operating profit, ROE, nor ROA1 targets.

On the other hand, I believe we laid the groundwork to grow our business over the next three years. For example, regarding our lithium-ion battery electrolyte IONELTM, we expanded production capacity in our main market, China, by addressing bottlenecks. We also plan to install new facilities in 2026. Furthermore, adding Emulsion Technology Co., Ltd., which handles waterproofing materials for construction, to our Group has enabled us to expand our product lineup in areas such as the high-performance emulsion2 business. We are also expanding our facilities for amines3, which are used in water treatment agents and CO2 absorbers, as well as for fine particles used in displays and semiconductors. Overall, these three years were also a period of steady preparation.

1 ROE: Ratio of profit to equity attributable to owners of parent, ROA: Ratio of profit before income tax to total assets

2 Emulsion: A mixture in which one liquid—such as water or oil—that is normally immiscible with another liquid is dispersed in the other liquid in a very fine state

3 Amines: Compounds in which the hydrogen atom in ammonia (NH3) is replaced by a hydrocarbon group

Mid-Term Management Plan 2027:

Concentrating investment and personnel in four growth areas

Q: Please explain the concept of the new Mid-Term Management Plan (MTMP).

A: Following the timeline I’ve outlined, we launched our new MTMP in April 2025. There is but one thing for us to accomplish: transform our business portfolio. Our Group has grown over many years by rolling out our acrylic acid (AA) and superabsorbent polymers (SAP) around the globe. Over the past 10 to 20 years, we’ve tried and failed to build new pillars of business beyond AA and SAP; but this time, I’m sure we will succeed. The new Mid-Term Plan was designed specifically to do that.

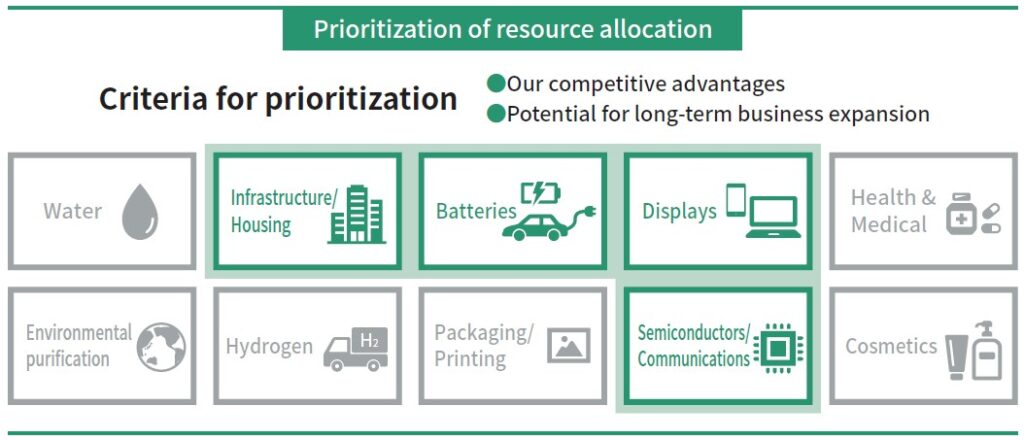

Based on lessons learned from the previous MTMP, the new MTMP narrows our focus to four growth business areas: Specialty, Electronics, Construction, and Energy (Batteries). As mentioned earlier, we have been laying the groundwork to enhance our production capacity in these fields. We have also newly allocated over 100 personnel to these areas. I believe our chances of success are higher than ever before.

Our target is to increase Solutions Business profit (operating profit + share of profit (loss) of investments accounted for using equity method) from the 6.1 billion yen of FY2024 to 18.5 billion yen in FY2027, raising its share of the total to over 50%. This would be a new scene for our Group, which has long relied on AA and SAP; but if we can meet this target, it will undoubtedly change the way both internal and external stakeholders view us. The Materials Business will continue to generate stable earnings, while the Solutions Business will help us grow. This is the new Nippon Shokubai.

Meanwhile, we will continue to lay the groundwork in areas beyond our four growth business areas. These will be Energy (hydrogen) and Health & Medical, which we are positioning as business areas for the next generation. In Energy (hydrogen), we are advancing the commercialization of large-scale separators for the decomposition of ammonia. We will further establish mass production systems for zirconia sheets used in solid oxide fuel cells (SOFCs), while also using these sheets in solid oxide electrolytic cells (SOECs) to produce hydrogen via the electrolysis of water. In Health & Medical, we are expanding our facilities to increase production capacity tenfold.

Nevertheless, in several areas, including these, we still lack sufficient groundwork. To further enhance production capacity and expand the scale of our business, I believe it is also necessary that we procure production resources and other assets externally through M&A and business integration. The three years of the new MTMP also serve as a period to advance these preparations. Without such preparation, we cannot achieve the targets of our Long-term Vision for FY2030.

Solutions Business: The four growth business areas are certain to grow

Q: What is the outlook for the four growth business areas?

A: Looking ahead to the new MTMP period and the business environment thereafter, all four growth business areas are expected to see significant growth. In Specialty, amines are growing thanks to demand for water treatment, and the market for CO2 absorbers is poised to take off soon, increasing the likelihood of explosive growth.

Electronics will see growth in products related to the semiconductor industry as that industry expands. China is the main market for displays and the market for high-definition large-screen LCD TVs is currently expanding there. We are aiming to supply components to meet this demand.

I view Construction as the most challenging of the four. In Japan, it will face declining demand due to the low birthrate; but because demand for high-performance coatings and adhesives will grow, we will shift our focus to those products. While competition is fierce overseas, we are aiming to become the preferred choice by creating high-quality, high-performance products that stay one step ahead.

Energy (Batteries) will undoubtedly grow, even though it is behind initial projections. We anticipate the shift to EVs will accelerate even among Japanese and European automakers going forward. At present, demand is particularly strong in China, where we have been producing IONELTM at full capacity but still cannot keep up with demand. Demand is certain to increase across all four business areas, so we plan to firmly establish our supply systems.

Materials Business: Targeting the rapidly-expanding Global South market

Q: In FY2024, Nippon Shokubai decided to invest in its Indonesian subsidiary PT. NIPPON SHOKUBAI INDONESIA. Please explain the global strategy for the Materials Business.

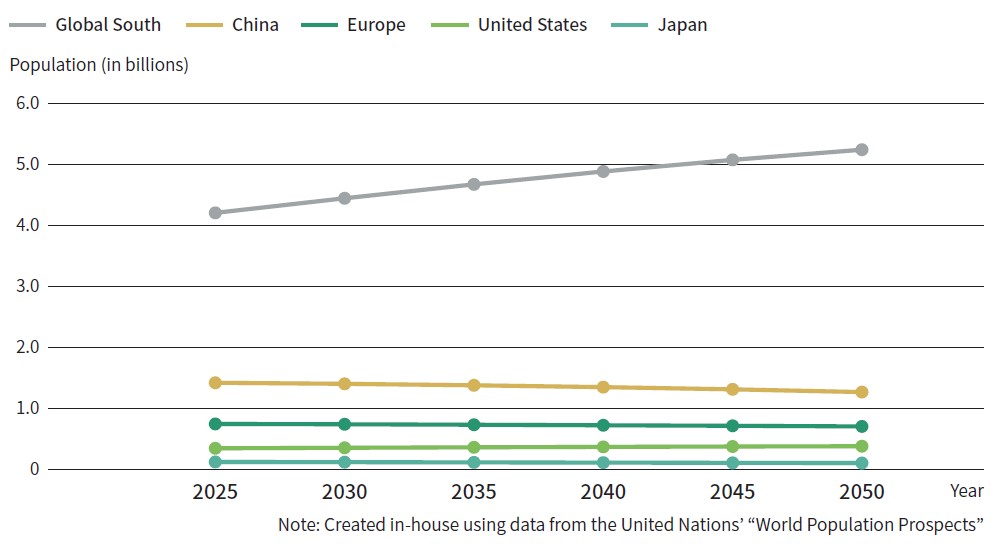

A: Within our new MTMP, the Materials Business fulfills the role of generating stable profits. We are currently increasing SAP production capacity in Indonesia; with operations set to begin in 2027, we plan to increase annual production capacity by 50,000 tons, bringing total local production capacity to 140,000 tons. Our target is the Global South market. Currently, the income-earning segment that can make use of disposable diapers is rapidly expanding in India, the Middle East, and Africa, so we can expect steady growth going forward. We plan to sell high-quality SAP to manufacturers that supply disposable diapers to these regions.

As for AA, we already have production sites worldwide and expect steady sales growth. Unlike SAP, AA products are difficult to differentiate based on quality or performance. However, because they are difficult to transport, having plants near markets with demand will be a strength. We plan to leverage this strength to generate stable profits.

World population projections

What matters is how we enhance overall corporate value

Q: Are there any additional measures that were implemented to enhance corporate value more efficiently?

A: Implementing the above strategies will require significant investment, mainly in growth business areas, necessitating the monitoring of capital efficiency. Therefore, we have newly added ROIC as a MTMP target. This decision also reflects our recognition that previous monitoring focused primarily on profit and loss, with a weak emphasis on capital efficiency. Each business division must be cognizant of how much equipment and inventory it holds to generate profits. What matters is how we enhance overall corporate value.

This is also why we shifted from the traditional operating profit target to an “operating profit + share of profit (loss) accounted for using equity method” target. The Chinese market is one example, so minority-owned joint ventures will also be an option going forward. This is because securing business opportunities while limiting capital investment would allow us to maintain financial flexibility while diversifying risk. Local joint venture partners have strong connections with local governments and know the market well. If they are reliable partners, entrusting them with majority control often leads to more effective operations, ultimately enhancing the corporate value of our entire Group.

We will also proceed with optimizing our shareholders’ equity ratio. While it stood at 70.5% at the end of FY2024, we plan to enhance capital efficiency by lowering it to 60%.

For FY2024, we set our dividend payout ratio at 100% and also announced a share buyback program totaling approximately 20 billion yen over the four years through FY2027. Although we have already seen some effects, the stock price remains in the 1,700 yen range as of the end of July 2025, and the PBR* is still at a low level. Going forward, we will aim to achieve a PBR* of 0.8 or higher for the time being by increasing earnings and improving capital efficiency.

*PBR: Price-to-Book Ratio

Bringing in diverse human resources

Q: Please tell us about the initiatives you are strengthening from a sustainability perspective.

A: We will further evolve the Strategic Transformation for Environmental Initiatives and Organizational Transformation initiatives that we advanced under the previous MTMP.

We place great emphasis on transforming our environmental initiatives because it directly connects to our corporate philosophy. We believe—because we are chemical manufacturers—that we can contribute to the environment through our diverse products. We possess technologies that benefit the global environment, from CO2 absorbers, to secondary battery materials, and hydrogen- and ammonia-related products. We are also advancing the development of biomass-derived acrylic acid. While the issue remains of who will bear the higher costs associated with environmentally friendly products, we intend to thoroughly prepare so that we are ready whenever that time comes.

As for the people aspect of organizational transformation, we are aiming to enhance diversity within the organization. Our basic policy is to attract human resources with diverse experiences and backgrounds through mid-career recruitment, while concentrating personnel in growth business areas. We have also begun implementing cross-departmental rotations to find the most suitable departments for placing human resources.

What matters is that we have diverse human resources within the organization. This is because diverse perspectives and ways of thinking make the organization stronger. We are also focused on hiring women, currently aiming for female employees to comprise 30% of administrative and chemical roles—although if we could, we would like to increase this to around half. To achieve this, we have begun creating an environment where women can work on the manufacturing floor. In terms of creating a better work environment, we renovated our offices in Osaka and Tokyo, with the plants and research center in Himeji and Kawasaki up next. We also plan to gradually make improvements across our Group companies.

Personally, I’d like us to hire more foreign employees, but the language barrier remains a persistent challenge. I’m really hoping AI can progress and help with that. Having diverse human resources join us would definitely provide a great stimulus.

Strengthening governance is also a key priority for organizational transformation. While we are a company with an Audit and Supervisory Board, we have already delegated significant executive authority, positioning the Board of Directors primarily for oversight and medium to long term strategic discussions. We also held quite in-depth discussions within Board of Directors meetings regarding the formulation of the new MTMP. We will continue to discuss within Board of Directors whether increasing the number of the Outside Directors of the Board, as seen in Europe and the United States, and solely strengthening the oversight function would be truly beneficial for the Company, as well as continue to seek a better approach.

A company in which everyone can place greater expectations

Q: Finally, please share a message for our stakeholders.

A: We now have just over five years remaining until the deadline for our Long-term Vision for FY2030. It’s about time to start envisioning the next long-term vision. I have some ideas myself, but I think it’s still too early to share them. A vision should be paired with strategy, and saying something now could potentially constrain those who follow me. I want the next generation to have the freedom to do things their way.

However, no matter what form the next vision takes, I imagine the core concept of TechnoAmenity will remain steadfast. While the wording itself may change, the message it embodies is universal for our Company.

I want to ensure we generate solid profits until then and enhance corporate value in various aspects. Furthermore, I aspire to make our Group one in which our stakeholders can place greater expectations than ever before. I sincerely look forward to everyone’s continued support.