Corporate Governance

We are working on continuously improving our systems and their operation to strengthen and enhance a viable corporate governance.

Our basic approach to corporate governance

Under the Nippon Shokubai Group Mission ”TechnoAmenity: Providing prosperity and comfort to people and society, with our unique technology,” we will increase our corporate value and achieve sustainable growth.

We consider viable corporate governance to be essential and have adopted initiatives toward that end. We ensure the rights and equality of our shareholders and maintain an open dialogue, collaborate with various stakeholders as appropriate, disclose information as appropriate and ensure transparency, ensure that the roles of Board of Directors and management teams relate to the appropriate execution of duties, ensure appropriate supervision of the execution of these duties and strengthen and enhance our internal control systems.

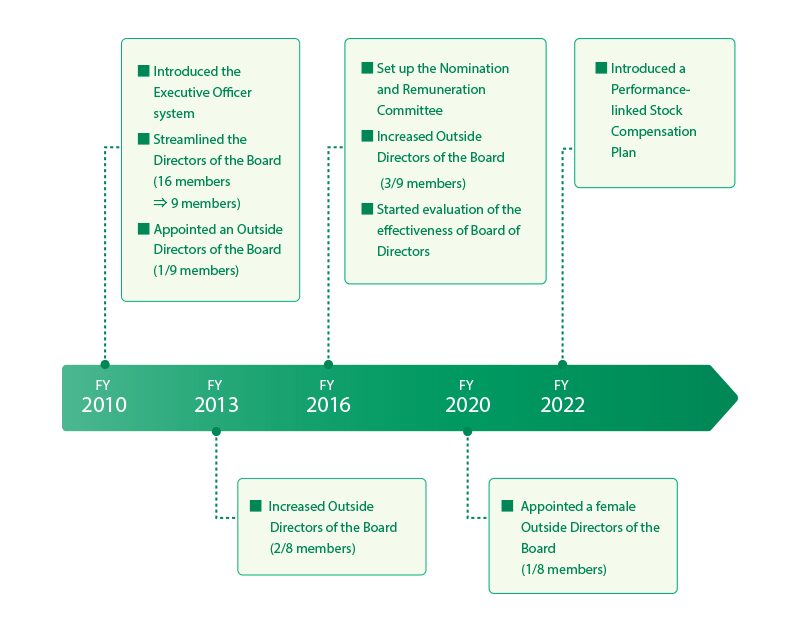

Initiatives to strengthen governance

Our basic information on corporate governance system

(as of June 19, 2025)

| Main Items | Content |

|---|---|

| Institutional design | Company with an Audit & Supervisory Board |

| Number of Directors of the Board | 8 (5 Inside, 3 Outside), including 2 female Directors of the Board |

| Ratio of Outside Directors of the Board (Independent Officers) | 38% |

| Term of office of the Directors of the Board | 1 year |

| Number of Board of Directors (FY2024) (Average attendance rate of Outside Directors of the Board / Outside Audit & Supervisory Board Members each) | 15 times (98% / 100%) |

| Number of Audit & Supervisory Board Members | 4 (2 Inside, 2 Outside) |

| Ratio of Outside Audit & Supervisory Board Members (Independent Officers) | 50% |

| Term of office of Audit & Supervisory Board Members | 4 years |

| Number of Audit & Supervisory Board (FY2024) (Average attendance rate of Outside Audit & Supervisory Board Members) | 15 times (100%) |

| Executive Officer system | Have already been introduced |

| Number of Executive Officers | 19, including 5 who concurrently serve as a Directors of the Board |

| Advisory body to the Board of Directors | Nomination and Remuneration Committee established |

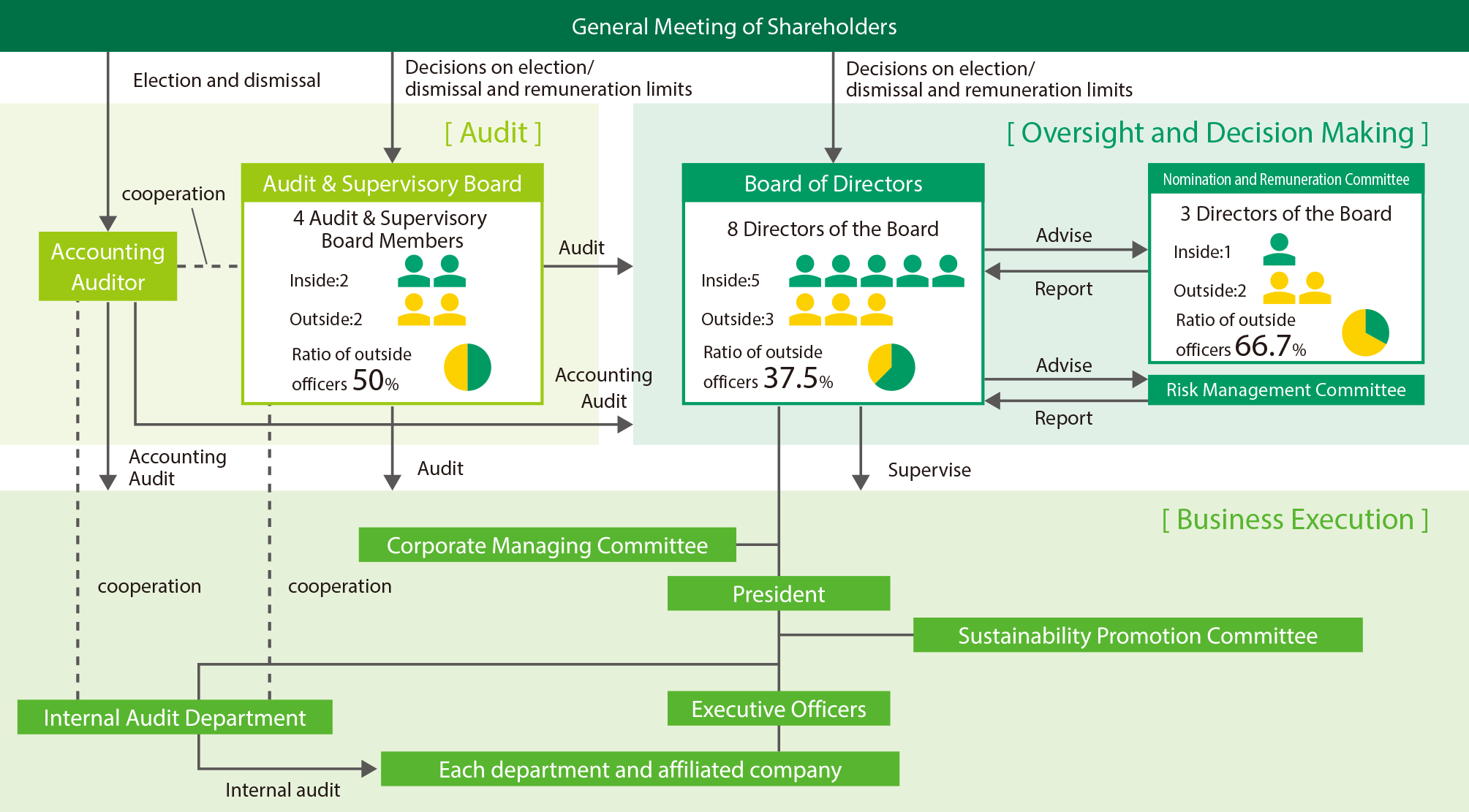

Our corporate governance system

(as of June 19, 2025)

Roles and Functions of Various Bodies and Committees

Board of Directors

Comprising eight Directors of the Board, including three Outside Directors of the Board, Board of Directors reports, deliberates and resolves important matters related to business operations, and supervises the business operations of each Director of the Board. In general, meetings are convened monthly under the chairmanship of a Director of the Board selected from members by a resolution of the Board of Directors. Four Audit & Supervisory Board Members, including two Outside Audit & Supervisory Board Members, also attend to give advice and state their opinions when necessary.

Corporate Managing Committee

Comprising the President and Executive Officers, this committee generally convenes once a month to deliberate on items related to the implementation of basic policies and important management issues. Among proposals discussed by the Corporate Managing Committee, important issues are forwarded to Board of Directors for consideration.

Audit & Supervisory Board

Comprising four Audit & Supervisory Board Members, including two Outside Audit & Supervisory Board Members, the Audit & Supervisory Board usually convenes monthly, submits reports and engages in discussions and deliberations on important matters related to audits.

Accounting Auditor

Nippon Shokubai is audited by Ernst & Young ShinNihon LLC.

Nomination and Remuneration Committee

An advisory body to the Board of Directors, this is a voluntary organization comprising three or more Directors of the Board (including a majority of Outside Directors of the Board). It advises on the election/dismissal of the President and Director of the Board, as well as draft nominations of candidates for Directors of the Board and Audit & Supervisory Board Member positions and on remuneration and bonuses for Directors of the Board.

Nomination and Remuneration Committee members

| Name | Status | Attendance rate |

|---|---|---|

| Kazuhiro Noda | President & CEO, Representative Director | 100% |

| Tetsuo Setoguchi | Outside Director of the Board | 100% |

| Miyuki Sakurai | Outside Director of the Board | 100% |

Risk Management Committee

An advisory body to the Board of Directors, this is an organization consisting of the president, who is the chairperson, and members appointed by the president. Based on consultation from the Board of Directors, it advises the Board of Directors on matters related to identification, response policies, response measures, and the person responsible for management of serious Group-wide risks, etc.

Sustainability Promotion Committee (formerly the TechnoAmenity Promotion Committee)

This is an organization consisting of the President, who is the chairperson, and members appointed by the President. We promote sustainability activities based on our belief that promoting sustainability means implementing the Nippon Shokubai Group Mission “TechnoAmenity: Providing prosperity and comfort to people and society, with our unique technology.” We consider promotion of sustainability activities as a core theme of our corporate management. The Committee is responsible for deciding policies and strategies therefor, providing instructions to relevant departments, and evaluating the results of the activities.

Internal Audit Department

The Internal Audit Department (6 members) conducts audits on the effectiveness and efficiency of each operational process, compliance and other matters from a standpoint independent from other executive sections, and thereby verifies the appropriateness of internal control of the Company. The Internal Audit Department strives to improve the effectiveness of internal audits by working in close cooperation with Audit & Supervisory Board Members and the Accounting Auditor through mutual exchange of information and opinions. Also, the Internal Audit Department holds regular opinion exchange meetings with Outside Directors of the Board and Outside Audit & Supervisory Board Members.

In addition, the results of internal audits are regularly reported to the President, the Board of Directors, Audit & Supervisory Board Members, and the Audit & Supervisory Board.

Policy and procedure for election/dismissal of Directors of the Board and Audit & Supervisory Board Members

The Board of Directors, including three Independent Outside Directors of the Board, decides on election/dismissal of management executives and nomination of candidates for Directors of the Board and Audit & Supervisory Board Members, taking thoroughly into account their expertise, experience, achievements, qualities, abilities, personalities and the like. Also, the Nomination and Remuneration Committee, a voluntary organization consisting mainly of Independent Outside Directors of the Board, has been established to receive advice on election/dismissal of the President and Director of the Board and nomination of candidates for Directors of the Board and Audit & Supervisory Board Members, thereby ensuring transparency and fairness in election/dismissal of the President and Director of the Board, and nomination of candidates for Directors of the Board and Audit & Supervisory Board Members.

Specialty and Experience of Directors of the Board and Audit & Supervisory Board Members

*1 In the table above, up to three main areas of specialty and experience are marked for each person.

*2 DX is an acronym for Digital Transformation.

Evaluation of the effectiveness of the Board of Directors

1.Process of evaluating the effectiveness of the Board of Directors

As an initiative to improve the effectiveness of the Board of Directors, the Company conducts surveys such as questionnaires to both of the Directors of the Board and Audit & Supervisory Board Members once a year to evaluate the effectiveness of the Board of Directors. In FY2024, we have implemented the evaluation through a third-party.

Evaluation Process of Board of Directors Effectiveness

- Attendance of the Board of Directors and survey of materials of the Board of Directors by a third-party organization

- Questionnaire for all Directors of the Board and all Audit & Supervisory Board Members

- Third-party interviews with all Directors of the Board and all Audit & Supervisory Board Members

- Summary of the result of the effectiveness evaluation at the Board of Directors

* The decision will be made each fiscal year regarding viewing and hearing to materials held by the Board of Directors and conducting interviews with all Officers

2.Items for improvement

The items for improvement identified in the evaluation of the previous fiscal year are as follows:

・Enhancing and actively engaging in discussions on key topics and the strategic direction of the Board of Directors

・Enhancing discussions within the Board of Directors and the Nomination and Remuneration Committee

・Implementing investor-focused information disclosure

3.Evaluation results and initiatives for the future

- It was confirmed that all the systems that support the composition, operation, deliberations/reports and the supervision of business execution of the Board of Directors were functioning properly and that the effectiveness of the Board of Directors was ensured. It was also confirmed that the measures taken based on the items for improvement identified in the evaluation of the effectiveness of the Board of Directors in the previous fiscal year had been implemented properly.

- To steadily achieve “stronger corporate governance” to foster sustainable growth and enhance medium- to long-term corporate value set forth in mid-term management plan launched in FY2025, we are currently making the following efforts:

≪Discussions towards strengthening the functions of the Board of Directors≫

- Ensuring opportunities for the Board of Directors to monitor and discuss the progress of the

company’s medium- to long-term management plan

- Implementing analysis of the factors contributing to variances between medium- to

long-term targets and actual progress

Outline of the executive remuneration system

1.Basic Policy

- To have Directors of the Board put the Company’s mission into practice and provide an incentive to sustainably enhance corporate value

- To have Directors of the Board share interests with shareholders according to the Company’s business results and commensurate with their responsibilities

- To set the executive remuneration system at a reasonable level in light of the Company’s business results, the level of employee salaries, and that of other companies

- To have the Nomination and Remuneration Committee, consisting mainly of Independent Outside Directors of the Board, deliberate on the matter, thereby ensuring transparency and fairness

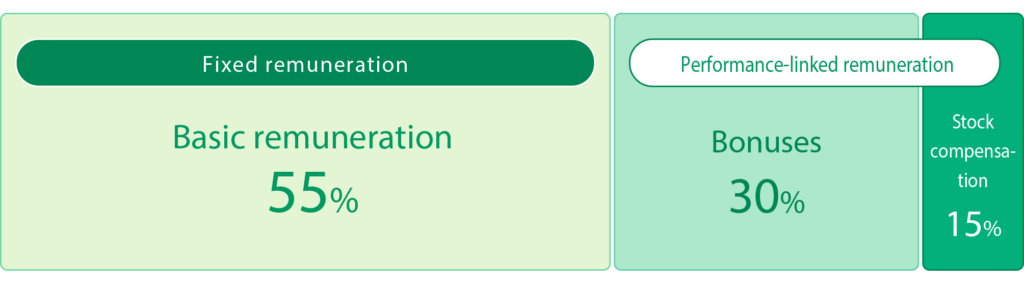

2.Components of the Remuneration

The remuneration for Directors of the Board (excluding Outside Directors of the Board) consists of basic remuneration, which is fixed remuneration, and bonuses and stock compensation, which are performance-linked remuneration. Outside Directors of the Board receive only basic remuneration as fixed remuneration because they oversee business operations from an independent standpoint.

The Ratio of remuneration for the Directors of the Board (excluding Outside Directors of the Board)

Outline of remuneration

| Fixed remuneration | Performance-linked remuneration | ||

|---|---|---|---|

| Basic remuneration | Bonuses | Stock compensation | |

| Type | Fixed remuneration | Short-term incentive | Medium- and long-term incentive |

| Persons to be paid | Directors of the Board | Directors of the Board (excluding Outside Directors of the Board) | Directors of the Board (excluding Outside Directors of the Board) |

| Method of payment | Money | Money | Shares and Money |

| Time of payment | Monthly | Paid at a certain time after the Ordinary General Meeting of Shareholders each year | Delivered and paid at a certain time after the end of each fiscal year |

| Description | -Paid based on the position and responsibilities. -The amount of remuneration for Outside Directors of the Board is determined by comprehensively considering the level of remuneration of the Company’s Officers, and that of other companies. | -Bonuses are paid according to evaluation indicators: the degree of achievement of key performance indicators (KPIs) and the degrees of achievement of individual performance targets. -KPIs consist of “operating profit ratio” and “operating profit,” with evaluation weights of 25% for “operating profit ratio,” 25% for “operating profit,” and 50% for “the degree of individual performance targets”. -The range of adjustment based on KPI achievement shall be 70 to 110% of the standard amount, and that based on individual performance targets shall be 80 to 120% of the standard amount. | -Utilizing the share benefit trust(Restricted Stock) mechanism for Officers, deliveries of shares and payments shall be made according to the number of points, which are linked to their positions in the Company and the achievement level of the mid-term management plan. -The above points are calculated based on standard points for each Director of the Board and a predetermined formula according to the achievement level of KPIs set forth in the mid-term management plan. -KPIs used for calculation consist of “ROE (ratio of profit to equity attributable to owners of parent),” “profit,” and “ROIC (return on invested capital)”, with evaluation weights of 40% for “ROE” 40% for “profit,” and 20% for “ROIC”. -The range of adjustment based on the degree of achievement shall be from 30% to 100% of the standard amount. |

3. Process for Determining Remuneration

- The Nomination and Remuneration Committee, a voluntary advisory organization consisting mainly of Independent Outside Directors of the Board, has been established. The Committee deliberates on policies, systems, and issues related to the determination of remuneration for Directors of the Board, as well as the appropriateness of the level of remuneration and the amount of remuneration for individual Directors of the Board, and reports back to the Board of Directors.

- Based on the Committee’s report, the Board of Directors determines the policy for determining the details of remuneration, etc. for each individual Director of the Board and details of remuneration, etc. within the framework of the amount of remuneration approved by the General Meeting of Shareholders. After the determination of the Board of Directors, the President and Director of the Board is entrusted with decisions regarding the amounts of basic remuneration and bonuses, excluding stock compensation, for individual Directors of the Board in light of the contents of the Committee’s report.

Aggregate Amount of Remuneration to Directors of the Board and Audit & Supervisory Board Members

| Category of positions | Aggregate amount of remuneration (million yen) | Aggregate amount of remuneration by type (million yen) | Number of persons to be paid (persons) | ||

|---|---|---|---|---|---|

| Fixed remuneration | Performance-linked remuneration | ||||

| Basic remuneration | Bonuses | Stock compensation | |||

| Directors of the Board (Outside Directors of the Board) | 342 (40) | 221 (40) | 105 (-) | 16 (-) | 9 (4) |

| Audit & Supervisory Board Members (Outside Audit & Supervisory Board Members) | 74 (20) | 74 (20) | - (-) | - (-) | 5 (3) |

| Total (Outside Officers) | 416 (60) | 295 (60) | 105 (-) | 16 (-) | 14 (7) |

*2 The amount of bonuses represents the amount of provision for directors’ bonuses for the current fiscal year.

*3 The amount of stock compensation is the amount posted for the current fiscal year.

Cross shareholding

Under the Nippon Shokubai Group Mission ”TechnoAmenity: Providing prosperity and comfort to people and society, with our unique technology,” we are willing to further advance our contributions to industry and society. To this end, Nippon Shokubai, as a chemical manufacturer, with a view to continuously improving its corporate value, believes that long and stable relationships of trust with business partners are important in development, production, sales and other activities. Based on this belief, we own shares of our partners for the purpose of cross share holding when deemed necessary.

Each year, the Board of Directors, including three Independent Outside Directors of the Board, comprehensively examines all the listed shares we own by issue in light of the above purpose, taking into consideration the capital costs, and confirms the importance of the shareholding. We sell shares if it is judged no longer important to hold such shares.

In FY2024, we sold all shares of three issues. As a result, the number of issues of cross shareholdings as of March 31, 2025 decreased from 70 as of the end of the fiscal year before the introduction of the Corporate Governance Code (March 31, 2015), to 30.

We plan to further reduce the number of cross-shareholdings from fiscal 2025 onward, with a policy of reducing such holdings by approximately 20 billion yen over the four years from fiscal 2024 through fiscal 2027.

Corporate Governance Report

For more details on our corporate governance initiatives, please refer to our Corporate Governance Report.